Battery Sales for xEV and ESS in 2022

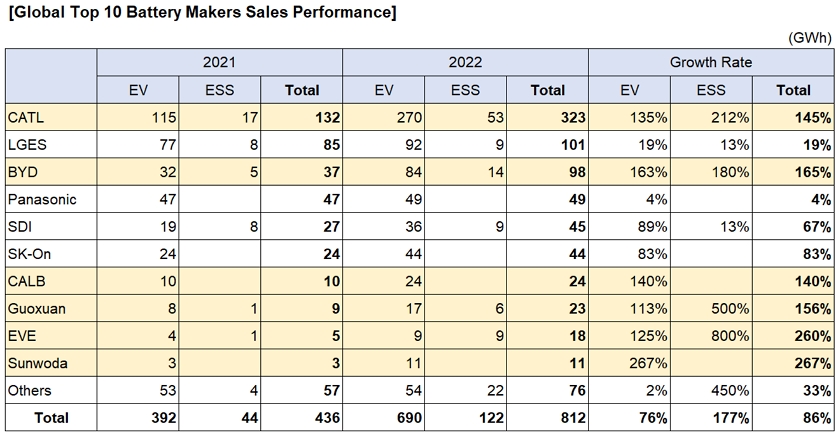

In 2022, the total sales of battery for xEV and ESS recorded 812GWh, a 86% growth from 436GWh in 2021.

While the xEV market posted 690GWh in 2022, a 76% growth from 392GWh in 2021, the ESS market enjoyed a high growth of 177% from 44GWh in 2021 to 122GWh in 2022 based on the buoyancy of the China and North America market.

The China market has experienced a rapid growth not only in the xEV but also ESS sector, leading to a huge growth of Chinese battery makers compared to the previous year. On the other hand, the growth rate of LG Energy Solution (LGES) and Panasonic, global top battery makers, remained at 19% and 4% respectively, showing a huge gap with the overall market growth rate, 86%.

The growth of global xEV market excluding China was relatively sluggish. Particularly when the xEV market in Europe, a target market of K-trio battery makers, has slowed down a bit, the Chinese battery manufacturers and EV makers have been proactively trailblazing in the overseas market. All of these have elevated the reputation of Chinese companies in the global market.

In the global xEV market excluding China, CATL ranked second to LGES on the list with the market share of 22% in 2022, slightly increased from 14% in 2021. Other Chinese EV makers including BYD, SAIC, and GREAT WALL MOTOR COMPANY has all expanded their sale of EVs in the Europe and Asia market.

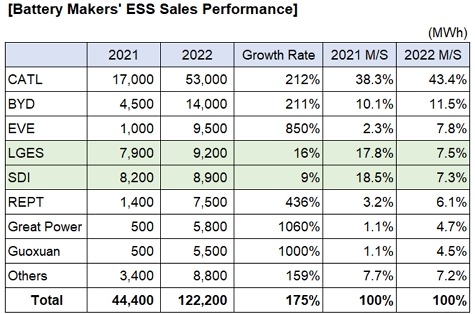

In the ESS sector, a demand and market for low-power, safety-oriented ESS linked to renewable energy has expanded. This increased preference to LFP battery, leading to a noticeable growth of Chinese LFP battery makers. Such transition to LFP battery is expected to accelerate further down the road.

Looking at the sales performance by each battery maker in 2022, CATL remained top on the list again. With an increased market share of 40% in 2022 from 30% in 2021, the Chinese maker widened the gap with LGES on the 2nd position.

LGES, with the market share of 12.4%, won a neck-and-neck competition with BYD (12.1%) and managed to stay on the 2nd place. Propped up with a high growth of 165% from 2021, BYD soared to the 3rd place in the ranking.

Panasonic, Samsung SDI, and SK On followed, ranked 4th, 5th, and 6th, respectively, but with such a small gap among them, a fierce competition is expected for higher places in the ranking.

CALB, a recent rising star, took the 7th place, while other Chinese companies such as Guoxuan, EVE, and Sunwoda successfully landed in the global top 10.

Looking more closely at the ESS sales performance by each battery maker in 2022, the combined market shares of Korean companies (SDI and LGES) in the global market had recorded over 50% till 2020. However, from 2021 when the Chinese companies including CATL started to promote low-priced LFP battery products in the global market, LFP battery has become a mainstream even in the North America market.

Even in the Chinese ESS market, it has become mandatory to install the energy storage system equivalent to the level of 10% or higher of renewable energy development capacity in accordance with the 14th Five-Year Plan (FYP). Provincial and municipal authorities have announced an extended subsidy policy to follow the guidelines stipulated by the Chinese government. Under this circumstance, the ESS sales performance by the Chinese battery makers has seen a magnificent growth in 2022 compared to the previous year. Such an upward trend in the Chinese ESS market is expected to continue till 2025 when the 14th Five-Year Plan terminates.